You know what keeps me up at night? I remember losing $6,000 worth of crypto in 2020 because I didn’t know about secure Bitcoin wallets. Yeah, that actually happened to me. But hey, at least my expensive mistake can help you avoid the same fate! After spending the last seven years immersed in cryptocurrency security, I’ve learned a thing or two about keeping those digital assets safe and sound.

Did you know that in 2023 alone, crypto users lost over $2 billion to hacks and scams? That’s exactly why choosing the most secure Bitcoin wallets is crucial. Let me walk you through everything I’ve learned about securing your crypto—no fancy jargon, just real talk from someone who’s been there.

Understanding Bitcoin Wallet Security Fundamentals

When I first started with Bitcoin, I thought keeping it on an exchange was the safest bet. I mean, they’re big companies, right? Boy, was I wrong! It’s like keeping all your cash in someone else’s pocket and hoping they won’t run away with it. Here’s the deal with different wallet types: There are basically two main categories: hot wallets (connected to the internet) and cold wallets (kept offline). Think of hot wallets as your everyday spending money, while cold wallets are like your long-term savings account but way more secure.

The most critical thing I’ve learned? Your private keys are everything. Lose those, and you might as well wave goodbye to your Bitcoin. I once wrote my private key on a sticky note and almost had a heart attack when I couldn’t find it for three days. Spoiler alert: it was stuck to the bottom of my coffee mug. Not my proudest moment!

Security features to look for include:

- Encryption (obviously!)

- Two-factor authentication (2FA)

- Seed phrase backup options

- Open-source code (so the community can check for vulnerabilities)

Types of Secure Bitcoin Wallets

Knowing the ins and outs of different wallets is necessary to keep your Bitcoin safe. Each kind has its own perks and safety measures.

Software Wallets Overview

Software wallets are like having a mini bank in my pocket. These apps let me handle my crypto with a tap or click. We’ve got the ‘hot’ ones, always online and great for quick, daily moves. Take something like Exodus: super easy to use but not impenetrable to hackers. Here’s a quick rundown of software wallets:

| Wallet Type | Security Level | Ease of Use | Cost |

|---|---|---|---|

| Desktop | Medium | Moderate | Free |

| Mobile | Medium | Very Easy | Free |

| Web | Low | Very Easy | Free |

For my long-term savings, I prefer security over convenience. Software wallets are about ease but are on thin ice compared to hardware ones. If you want to dive deeper, check out our crypto wallet guide.

Hardware Wallets Explained

Hardware wallets are my go-to for maximum security. They stash my private keys offline, making it a hassle for anyone trying to mess with them. The average cost is around a hundred bucks, but it’s worth every penny. Think of brands like Ledger or Trezor, the Fort Knox of Bitcoin storage.

After my early mishaps with software wallets, I finally invested in a hardware wallet, and let me tell you – it was like upgrading from a bicycle lock to a bank vault. Sure, they’re not cheap, but neither is losing your crypto!

The Ledger Nano series has been my go-to for years. I started with the Trezor Model One, then switched to the Ledger Nano S, but recently upgraded to the Nano X. The screen on the S was tiny and sometimes drove me nuts, but the X is much better. Remember to buy directly from Ledger—I’ve heard horror stories about pre-compromised devices from third-party sellers.

Trezor’s pretty solid, too. Their Model T is basically the Mercedes of hardware wallets. It’s pricey, but the touchscreen makes it super easy to use. I actually dropped mine in a pool once (don’t ask), and after drying it out, it still worked perfectly! Though I wouldn’t recommend testing that yourself.

Here’s a peek at the top hardware wallets:

| Wallet Name | Security Level | Storage Type | Cost Range |

|---|---|---|---|

| Ledger | High | Offline | $80-$200 |

| Trezor | High | Offline | $50-$200 |

| BitBox02 | High | Offline | $100-$200 |

Trading straight from the wallet means avoiding sketchy exchange wallets, offering a safe haven for my stash. Want to know more about safety? Take a look at Kaspersky’s explanation.

Paper Wallets vs. Hardware Wallets

Remember paper wallets? They were all the rage back then, like tiny treasure maps with printed keys and QR codes. But they’re a bit outdated now—easily damaged or lost. Keep them locked up safe if you use them, but they’re risky (Investopedia). Here’s how they match up:

| Wallet Type | Security Level | Accessibility | Risk Factors |

|---|---|---|---|

| Paper Wallet | Medium/High | Low | Damage, Loss, Theft |

| Hardware Wallet | High | Moderate | Device malfunction, Theft |

Choosing comes down to what I feel comfortable risking. Paper wallets can still work if cared for, but hardware wallets provide top-notch security for my everyday trades. Curious about various wallets? Check out this detailed article.

Multi-Signature Wallets

Let me share a nifty trick that I’ve stumbled upon in my quest to keep my digital treasures safe: the magic of Multi-Signature (Multi-Sig) wallets. These bad boys have become my go-to for adding that extra wall of protection around my cryptocurrency stash.

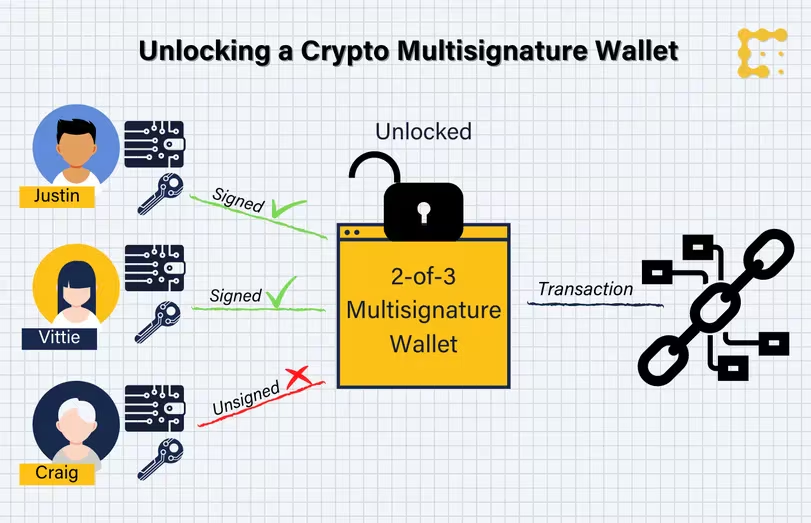

How Multi-Sig Wallets Work

Imagine a lock that requires only one or two keys but several to open. That’s the concept behind Multi-Signature (Multi-Sig) wallets. To make a transaction, you need to gather several people to approve it. For example, in a 3-of-4 wallet, three out of four individuals must provide their consent before any action can be taken. If a hacker attempts to steal my digital assets, they will have a tough time unless they can rally all the necessary people for a group effort. It offers solid peace of mind. (Coinbase).

Unlike traditional single-signature wallets, where losing a key can lead to disaster, multi-signature wallets allow me to distribute access among trusted friends and family. Each transaction requires approval from multiple parties, which helps prevent unauthorized activities. These wallets offer top-notch security for both individual users and groups looking for a reliable solution. (Bitpanda).

| Signature Type | Required Signatures | Example Use Case |

|---|---|---|

| 2-of-3 | 2 of 3 signers | Small team treasure chest |

| 3-of-4 | 3 of 4 signers | Business handshake deal |

| 1-of-2 | 1 of 2 signers | Joint kitty collection |

Security Benefits of Multi-Sig Wallets

I have to say, the safety benefits here are fantastic. The extra keys significantly reduce the chances of someone stealing my stash. If one key holder mismanages things, my savings remain secure. Involving my group of trusted individuals fosters a sense of shared responsibility and trust. (Bitpanda). Check this out: these systems work well with the Lightning Network, enhancing both security and speed. Every transaction does not need to congest the blockchain, allowing everything to run more smoothly and quickly.

This aligns perfectly with my goal of navigating the digital landscape without fearing a shipwreck (Bitpanda). In my never-ending mission to shield my investments, I see Multi-Signature wallets as a trusty sidekick that’ll always have my back. They offer that much-needed safeguard and control to keep my digital goods under lock and key.

Setting Up Your Bitcoin Wallet Securely

Setting up your wallet might initially seem overwhelming, but trust me, it’s not rocket science. However, I once spent an hour figuring out why my hardware wallet wasn’t connecting, only to realize it wasn’t plugged in properly. We all have those moments! Here’s my tried-and-true setup process:

- Find a quiet, private space (no coffee shops!)

- Write down your seed phrase on paper (not digital!)

- Triple-check every word

- Store copies in multiple secure locations

Common Bitcoin Wallet Security Mistakes to Avoid

Where do I start? I’ve seen (and made) almost every mistake in the book. For example, when I tried to be clever and create a “secure” password that was so complex, I locked myself out of my wallet for a week! The biggest mistakes I see people make:

- Using simple passwords (your cat’s name isn’t secure, even with a few numbers added)

- Storing seed phrases digitally (screenshots are a big no-no)

- Ignoring software updates (yes, they’re annoying but necessary)

- Using public WiFi for transactions (just don’t)

Advanced Security Features for Power Users

Once you’ve mastered the basics, you might want to level up your security game. Multi-signature setups are like having multiple keys to a safe—you need more than one to access the funds. They’re a bit of a pain to set up (it took me a whole weekend), but the peace of mind is worth it. Air-gapped operations sound fancy, but they keep your signing device completely offline. I use an old laptop without wireless cards for this. My friends think I’m paranoid, but better safe than sorry!

Final Thoughts on Bitcoin Wallet Security

After all these years in the crypto space, the most important lesson I’ve learned is that security isn’t about having the most expensive wallet or the most complex setup—it’s about being consistent with basic security practices. Remember, the perfect wallet setup is the one that balances security with usability for YOUR needs. Maybe you don’t need a maximum-security setup like mine if you’re just starting out.

But whatever you do, please don’t store significant amounts on exchanges or in hot wallets. Learn from my expensive mistakes! Do you have questions about setting up your wallet? Post them in the comments below! I check in regularly to help folks avoid the same pitfalls I encountered.

Stay safe out there, and remember—not your keys or coins!

Frequently Asked Questions

What is the best bitcoin wallet for beginners?

The best bitcoin wallet for beginners is often a user-friendly mobile wallet like Coinbase or Blockchain.info, which offer simple interfaces and easy access to your funds.

How do I choose the best bitcoin wallet for security?

To choose the best bitcoin wallet for security, look for wallets that offer features like two-factor authentication, multi-signature support, and hardware wallets like Ledger or Trezor for added protection.

Is there a free option for the best bitcoin wallet?

Yes, several free options exist for the best bitcoin wallet, including Exodus and Electrum, which provide solid features without any cost while prioritizing user control over private keys.

What are the differences between hot and cold wallets when considering the best bitcoin wallet?

Hot wallets are connected to the internet and offer convenience for frequent transactions, while cold wallets, like hardware wallets, provide higher security by storing your bitcoins offline, making them ideal for long-term investors.

Can I use multiple wallets to find the best bitcoin wallet for my needs?

Absolutely! Using multiple wallets can help you manage your bitcoin investments more effectively, allowing you to separate funds for trading, savings, and daily spending, ultimately enhancing your overall security and accessibility.

![[secure bitcoin wallets]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405725x325769434323760060-feature-750x375.png)

![[crypto asset security]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405711x482955841305053900-feature-350x250.png)

![[cryptocurrency wallets]](https://cryptohashira.com/wp-content/uploads/2024/10/1730320405708x158684408553168900-feature-350x250.png)

![[secure bitcoin wallets]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405725x325769434323760060-feature-120x86.png)

![[crypto asset security]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405711x482955841305053900-feature-120x86.webp)