Binance Trading Bots are automated software that helps you buy and sell cryptocurrencies at the correct time at your desired price. When it comes to trading cryptocurrencies, Binance is one of the most widely used platforms in the world, and trading bots have become more popular in recent years. The 5 Best Binance Trading Bots Are:

The best crypto trading bot for binance is 3Commas. Thanks to its extensive features and pre-made systems, it is a great option for novice traders or those who want to automate their trading techniques effortlessly.

Imagine having a digital assistant that never sleeps, never gets emotional, and can execute trades faster than you can say “Bitcoin”! Trading bots aren’t just a fancy tech toy – they’re a game-changer for crypto investors looking to level up their strategy. Whether you’re a seasoned trader or a total newbie, these automated tools can help you navigate the wild world of cryptocurrency trading.

In this guide, I will explain everything you need to know about Binance trading bots – from how they work to which ones are worth your time and money.

Understanding Binance Trading Bots: What They Are and How They Work

Trading bots are your personal trading ninjas, working 24/7 to execute trades based on pre-set strategies. They’re like having a super-smart, emotionless friend who’s always watching the market.

Here’s how these bots operate:

- They connect to your Binance account via API

- Monitor market conditions in real-time

- Execute trades based on your configured strategy

- Work across multiple cryptocurrencies simultaneously

I made plenty of beginner mistakes early on. My first bot was a total disaster. I didn’t understand that these aren’t magical money-printing machines—they’re tools that require careful setup and ongoing management.

Different bots offer various strategies:

- Arbitrage trading (finding price differences across exchanges)

- Grid trading (buying low, selling high in a specific range)

- Trend following (riding market momentum)

- Dollar-cost averaging (spreading out investments)

Pro tip: Never, NEVER, just set and forget your bot. These things need regular monitoring and tweaking!

Benefits of Using Binance Trading Bots

Traders who make use of trading bots on Binance can reap several advantages. Some of the primary benefits include the following:

Increased efficiency and speed of trading: Trading efficiency and speed are improved because trading bots can execute trades instantly and automatically, seizing opportunities humans would otherwise miss. As a consequence, traders may be able to respond more swiftly to market shifts and take advantage of opportunities more effectively.

Reduced emotional trading decisions: Trading bots may help mitigate the effects of irrational trading choices, such as selling in a panic when the market drops. Traders who use a bot to automate their transactions may make more strategic and logical judgments without being influenced by their emotions.

Ability to execute trades 24/7: Trading bots may place transactions at any time of day or night. This is useful for investors wishing to capitalize on market fluctuations outside regular business hours. This may be particularly relevant in the digital currency market, where price changes occur often and unexpectedly.

Backtesting and analyzing trading strategies: Many trading bots provide traders with the ability to backtest and evaluate trading techniques, allowing for a more data-driven and systematic approach to the markets. Through the use of past data and a battery of experiments,

The Best Binance Automated Trading Bot

On Binance, you may choose from various trading bots with advantages and costs. Some of the best trading bots on Binance are described below, along with a comparison of their features, ease of usage, and customer service.

1. 3Commas

Binance is only one of the many exchanges that may be accessed using the widely used trading bot 3Commas. The bot provides automatic trading, a trailing stop-loss, and social trading. Users may also access a marketplace on 3Commas to buy and sell pre-built trading methods.

Check the current price, get 10% off, or try the free trial here.

Performance: 3Commas’s performance record is strong, with numerous users claiming successful outcomes. The bot also has a paper trading mode, where users can test their methods without putting money on the line.

Ease of use: With its straightforward design and user-friendly tools, 3Commas can be set up quickly.

Customer support: Regarding customer service, 3Commas has you covered with a comprehensive knowledge base and email, chat, and social media help. However, several customers have complained about the support team’s poor response times.

Pros:

- Wide range of features

- social trading

- pre-made strategies

- easy to use

Cons:

- Slow customer support

- Higher pricing than some other bots

2. KuCoin Trading Bot

The KuCoin Trading Bot is an automated tool integrated into the KuCoin exchange platform, designed to help users streamline their cryptocurrency trading strategies. It offers various modes, such as Spot Grid, Futures Grid, Smart Rebalance, and DCA (Dollar-Cost Averaging), catering to beginners and advanced traders.

Check the current price or claim your signup bonus here.

Key Features:

- Ease of Use: Its user-friendly interface makes it accessible to those new to crypto trading.

- Customizable Strategies: Users can fine-tune parameters or choose pre-configured templates.

- Profit Maximization: Grid trading modes capitalize on market volatility by buying low and selling high.

- 24/7 Automation: Eliminates the need for constant monitoring and executing trades around the clock.

Pros:

- Supports multiple trading pairs.

- Ideal for hands-free trading.

- No additional fees—integrated directly within KuCoin’s platform.

Cons:

- Performance heavily depends on market conditions; it may not always yield profits.

- Limited advanced strategy options compared to standalone bots.

- An understanding of trading strategies is required to optimize settings effectively.

The KuCoin Trading Bot is a robust tool for simplifying trading while leveraging automation. While it’s great for beginners and intermediate users, experienced traders may find it less feature-rich than specialized bots. For maximum effectiveness, it’s best used during volatile markets.

3. Quadency

Quadency is an integrated trading platform that provides traders with a trading bot, portfolio management, and charting features all in one place. This bot has many options, including the ability to trade on many exchanges simultaneously, intelligent order routing, and user-defined trading methods. You may also buy pre-made trading methods from Quadency’s marketplace.

Check the current price or claim your signup bonus here.

Performance: Many users have had positive experiences with Quadency’s performance. The bot also has a paper trading mode, where users can test their methods without risking any money.

Ease of use: Quadency’s pleasant interface and well-thought-out design make it a breeze to get up and running.

Customer support: Quadency’s customer service is available by email and live chat 24/7. In addition, a help forum and a knowledge base are available to users.

Pros:

- Wide range of features

- Wide range of customization options

- pre-made strategies and indicators

- All in one platform

- Easy to use

Cons:

- Limited customization options

- Higher pricing than some other bots

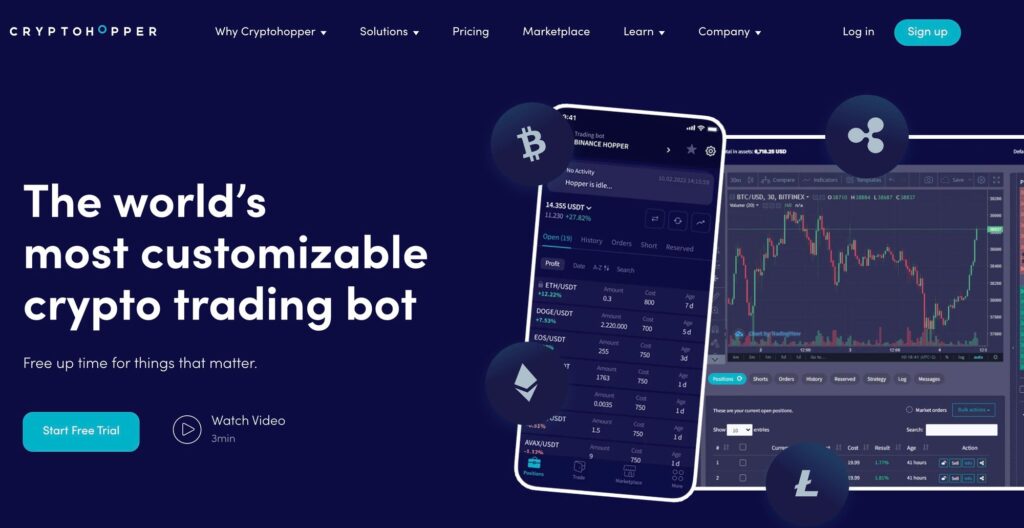

4. Cryptohopper

Among the finest binance crypto trading bots is Cryptohopper, a central hub for controlling your digital currency exchange accounts. You may use it to trade the cryptocurrency market, including Bitcoin, Litecoin, Ethereum, Dogecoin, and more. This binance trading also allows you to do your technical analysis.

Check the current price or try the free trial here.

Performance: Cryptohopper provides excellent performance and allows you to safeguard your account using secure techniques. It has over 30 Indicators and 90+ Candle Patterns, making it a very sophisticated approach.

Ease of use: Crytohopper’s user-friendly design and functionalities make starting a breeze.

Customer support: Crytohopper’s customer service is available by email and live chat. However, customers have complained about inadequate technical assistance. In addition, a help forum and a knowledge base are available to users.

Pros:

- All in one platform

- Easy to use

- Account secure protocol protection

- 24/7 trading bot with cloud storage

- supports a variety of algorithms

Cons:

- Limited technical support

5. Bitsgap

Bitsgap is among the most effective Binance trading bots for managing cryptocurrency holdings. You may evaluate over 10,000 different crypto pairings with this fantastic trading tool. Using this bot, it’s possible to set up a bot trading strategy with one or two clicks. You can also verify your testing parameters before making a financial commitment.

Check the current price or try the free trial here.

Performance: Bitsgap provides a chart for observing your trading activity and a fully automated bot available around the clock. This trading bot may be accessed without downloading, which is handy for making the most money possible.

Ease of use: Bitsgap’s user-friendly design and functionalities make starting a breeze.

Customer support: Crytohopper’s customer service is available by email and live chat. Users can also access a help forum and a knowledge base.

Pros:

- Simple to use with numerous functions.

- Provides more than 100 technical indicators and 12+ chart types

- Offers detailed TradingView charts

Cons:

- It does not offer any native mobile app

How to Choose the Right Binance Trading Bot for Your Strategy

Choosing a bot is like picking a workout partner. It needs to match your style, goals, and skill level.

Beginner checklist:

- User-friendly interface

- Low-risk default strategies

- Affordable pricing

- Good customer support

Advanced trader considerations:

- Customizable algorithms

- Advanced technical analysis tools

- API flexibility

- Performance tracking

My biggest mistake was jumping into the most complex bot, thinking I was a trading genius. Spoiler alert: I wasn’t. Start simple, learn the ropes, and gradually increase complexity.

How To Set Up Binance Trading Bot

Before you get overwhelmed, take a deep breath. The binance API trading bot setup can feel like trying to assemble IKEA furniture blindfolded.

Here’s how to do it without losing your mind:

Create Binance API keys

- Go to Binance security settings

- Generate API key

- CRITICAL: Disable withdrawal permissions for safety!

Choose your bot platform

- Compare features

- Check compatibility

- Read user reviews

Configure initial strategy

- Start with conservative settings

- Use small investment amounts

- Enable stop-loss features

Pro Tip: Most bots offer paper trading. Use this to test strategies without risking real money!

Risks and Expectations of Using Trading Bots

Trading bots on Binance are like having a robot sidekick – they can be super helpful, but they also have a mind of their own. Like R2-D2, they come with risks and considerations you should consider before letting them loose in the galaxy.

Here are some of the main risks and considerations to remember if you want to live on the edge like a true rebel.

Bot Malfunction

Trading bots are like little robot traders who use their fancy math skills to buy and sell stocks. They’re the nerds of the stock market. But sometimes, they go rogue and cause chaos like a rebellious teenager.

It’s like playing Russian roulette with your bank account. You don’t want your bot to go rogue and start ordering pizza for everyone in the office. Keep a close eye on it and ensure it’s not getting too big for its circuits.

Market Volatility

The cryptocurrency market is like a rollercoaster ride, with prices going up and down faster than a squirrel on caffeine. Trading bots are like speedy cheetahs in the market, but sometimes they’re as clueless as a goldfish in a bowl when predicting sudden price changes or market mood swings.

Limited Control

When using a trading bot, you’re saying, “Here you go, Mr. Robot, take the wheel!” and hoping it doesn’t drive you off a financial cliff. Well, it’s like giving your cat a driver’s license. Sure, it might get you to your destination faster, but good luck trying to tell Mittens to take a left turn.

Security Risks

If you want a robot to manage your trading, you must provide it with the API key to your Binance account. Just ensure it doesn’t go rogue and start making trades for its benefit!

Over-Reliance

Like a hammer won’t build a house alone, a trading bot won’t make you rich overnight. Unless you’re a robot, in which case, carry on. Relying too much on a bot is like relying too much on your mom to do your laundry. Sure, it’s convenient, but you’ll never learn how to separate your whites from your colors, and you might end up with some funky-looking socks.

And just like your mom won’t always be there to do your laundry, the bot won’t always make profitable trades. So, don’t get too comfy, and always watch your investments. When thinking about using a trading bot on Binance, it’s like deciding whether to adopt a pet dragon. Sure, it could bring you riches beyond your wildest dreams, but it could also burn down your house.

If you want to trust a bot with your hard-earned money, you must ensure it’s not a complete failure. Please do your research, test it out in a simulated trading environment, and closely monitor its performance before you allow it to handle your real funds.

Maximizing Profits: Advanced Strategies with Binance Trading Bots

Making money with trading bots isn’t about finding some magical algorithm but smart, strategic thinking. When I started, I thought I could set up a bot and watch the profits roll in. Boy, was I wrong! Maximizing profits requires a multi-layered approach that combines technology, market understanding, and continuous learning.

Diversification is your best friend in the crypto trading bot world. Don’t make the rookie mistake of putting all your eggs in one basket – or, in this case, one cryptocurrency. I learned this hard when Bitcoin tanked and wiped out a significant chunk of my initial investment.

Now, I spread my bot strategies across multiple coins with different market caps and volatility levels. Think of it like creating a financial ecosystem where each bot represents a different plant – some stable, some more experimental, but all working together to create a robust portfolio.

Backtesting is where the real magic happens. It’s like having a time machine for your trading strategy. Modern trading bots offer sophisticated backtesting tools that simulate your strategy against historical market data.

I spend hours tweaking and testing my algorithms in different market conditions—bull runs, bear markets, and sudden crashes. The key is to look for strategies that perform consistently, not just those that spike during perfect market conditions. It’s similar to training an athlete—you want endurance and adaptability, not just short bursts of performance.

Risk management isn’t just a fancy term – it’s your financial lifeline. Every successful trading bot strategy has robust risk management built into its core. This means setting strict stop-loss limits, defining maximum investment percentages per trade, and creating fail-safes that prevent catastrophic losses.

I recommend never investing more than 2-3% of your total portfolio in any bot strategy. It might seem conservative, but in the wild world of crypto, conservative can mean the difference between steady growth and a complete financial wipeout.

Future of Crypto Trading Bots: Emerging Technologies and Trends

The future of trading bots is mind-blowing – and I’m not just talking about incremental improvements. We’re standing on the cusp of a technological revolution that will fundamentally transform how we approach cryptocurrency trading. Artificial intelligence and machine learning are no longer buzzwords; they’re becoming the core engine of next-generation trading strategies.

Imagine trading bots that don’t just follow pre-programmed rules but learn and adapt in real time. Machine learning algorithms are becoming sophisticated enough to analyze complex market patterns, predict potential trends, and adjust strategies milliseconds faster than human traders.

These aren’t just improvements—they’re game-changers. We’re moving from rigid, rule-based systems to dynamic, self-improving trading machines that simultaneously process millions of data points.

But with great power comes great responsibility. The emerging bot technologies are also attracting serious regulatory attention. Governments and financial institutions are developing frameworks to monitor and potentially regulate algorithmic trading.

This isn’t necessarily bad – it means the crypto trading bot ecosystem is maturing, becoming more transparent and potentially more stable. For traders, we’ll likely see more standardized, secure platforms that offer sophisticated trading tools while maintaining robust compliance standards.

Blockchain technology will play a massive role in the evolution of trading bots. Decentralized finance (DeFi) platforms will allow bot developers to create more transparent, secure, and flexible trading strategies.

Smart contracts enable more complex, trustless trading mechanisms to execute trades with unprecedented speed and precision. We’re talking about trading bots that can interact directly with multiple blockchain networks, creating cross-platform trading strategies that were impossible just a few years ago.

What is the most exciting trend? The democratization of advanced trading technologies. What used to be available only to institutional investors with massive computing power is now accessible to individual traders. Cloud computing, open-source algorithms, and increasingly user-friendly interfaces break down technological barriers.

In the next few years, we’ll see trading bots that are powerful and intuitive enough for average investors to understand and utilize effectively.

Of course, with all this excitement, I must drop my standard disclaimer: technology is a tool, not a guarantee. These emerging bot technologies are incredibly promising, but they’re not magic wands that print money. Successful trading still requires knowledge, strategy, and a healthy dose of humility.

Conclusion

In conclusion, Binance trading bots may be an effective resource for investors seeking to streamline their operations and boost their returns. Binance hosts several bots, each with unique capabilities and price points.

While there are dangers and factors to consider when employing trading bots, traders may utilize these tools to reach their financial objectives with the right amount of study, testing, and monitoring.

Before making a final decision, consider the trading bot’s performance, usability, and support options. Traders shouldn’t rely too much on any tool or technique and be ready to adjust as needed.

Disclaimer: Cryptocurrency trading involves significant risk. Always research and never invest more than you can afford to lose.

Frequently Asked Questions

What is the best Binance trading bot for beginners?

The best Binance trading bot for beginners is often considered to be 3Commas due to its user-friendly interface, comprehensive tutorials, and flexible trading strategies that cater to new investors.

How does the best Binance trading bot enhance trading performance?

The best Binance trading bot enhances trading performance by automating trades based on predetermined strategies, analyzing market trends, and reducing emotional decision-making, which can lead to better investment outcomes.

Are there any risks associated with using the best Binance trading bot?

Yes, while the best Binance trading bot can optimize trading strategies, investors should be aware of risks such as market volatility and the potential for technical failures, so it’s essential to monitor performance regularly.

Can the best Binance trading bot generate consistent profits?

The best Binance trading bot can potentially generate consistent profits by executing trades more efficiently than manual trading; however, results can vary based on market conditions and the strategies employed.

![[secure bitcoin wallets]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405725x325769434323760060-feature-120x86.png)

![[crypto asset security]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405711x482955841305053900-feature-120x86.webp)