Cryptocurrency security seems obvious until you realize how many people get into the crypto world without ensuring they can safely navigate the dangerous crypto jungle. Did you know that in 2022, a mind-boggling $3.8 billion worth of cryptocurrency was lost to hackers and scammers? That’s right, I’m not pulling your leg – this staggering figure from Chainalysis sent shivers down my spine when I first read it.

As someone in the crypto game for years, I can’t stress enough how crucial it is to take your Cryptocurrency security seriously. When I first dipped my toes into the crypto waters, I was all starry-eyed about the potential gains and didn’t give much thought to security. Boy, was that a rookie mistake! After a phishing attack that cost me my precious Ethereum, I learned that in this wild west of digital finance, you’ve got to be your own sheriff.

That’s why I’m here today – to share the security wisdom I’ve gathered through blood, sweat, and, yes, a few tears. This cryptocurrency security guide will cover everything from the basics of crypto wallet security to advanced techniques that make you feel like the Saturo Gojo of crypto. Whether you’re a newbie just buying your first fraction of Ethereum or a seasoned hodler, I promise you’ll find something valuable here. So, grab your favorite crypto-themed mug, settle in, and let’s dive into the nitty-gritty of keeping your digital coins safe and sound in 2024!

Understanding the Cryptocurrency Security Landscape

The cryptocurrency security landscape is like a digital jungle, teeming with predators looking for their next meal. And guess what? Your crypto is the juicy steak they’re after. From garden-variety phishing attempts to sophisticated smart contract exploits, the threats are as diverse as they are dangerous.

Let me paint you a picture of what we’re up against:

- Phishing attacks are the digital equivalent of those cheesy “You’ve won a million dollars!” emails—except now they’re slicker than a greased pig. I once nearly fell for a website that looked identical to my regular exchange—down to the last pixel!

- Malware: Remember when the scariest computer virus just made your screen go all wonky? Those were the good old days. Now, we’ve got keyloggers and clipboard hijackers that can swipe your private keys faster than you can say “blockchain.”

- 3. Exchange hacks: Not to sound like a broken record, but “not your keys, not your coins” isn’t just a catchy phrase. Major exchanges have been hacked more times than I’ve had hot dinners.

- 4. Social engineering: This is where the human element comes into play. Scammers are getting craftier, using psychological tricks to manipulate people into giving up their precious crypto info.

- 5. Smart contract vulnerabilities: For all you DeFi enthusiasts out there (myself included), a single bug in a smart contract can drain millions faster than you can say “gas fees.”

The nature of these threats is constantly evolving. Just when you think you’ve got it all figured out, boom! A new type of attack emerges. It’s like playing whack-a-mole but with your life savings on the line. I don’t mean to scare you—well, maybe a little. But fear not! Knowledge is power, and understanding these threats puts us one step ahead of the bad guys. In the following sections, we’ll explore how to protect ourselves from each of these scammers. Remember – in the crypto world, paranoia isn’t just healthy; it’s essential. So, let’s channel that paranoia into some rock-solid security practices!

![[crypto asset security]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405711x482955841305053900-feature-1024x585.webp)

The Basics Of Cryptocurrency Security

- Hot vs. Cold Wallets: Think of hot wallets as your spending money and cold wallets as your savings account. Hot wallets are connected to the internet – convenient but more vulnerable. On the other hand, cold wallets are offline – like that bunker you’ve been thinking about building in your backyard. My advice? Use a hot wallet for your day-to-day crypto shenanigans, but keep most of your hodlings in cold storage. I learned this after sweating bullets whenever I checked my hot wallet balance during a bull run.

- Private Key Management: Your private key is like the secret recipe for your grandma’s famous apple pie—guard it with your life! Never, and I mean NEVER, share it with anyone—not your best friend, not your significant other, and certainly not that nice prince from Nigeria who emailed you.

- Passwords and Passphrases: Gone are the days when “password123” cut it. You need a password longer than the wait for the ending of Hunter x Hunter and more complex than Hakari’s domain expansion. And for the love of Satoshi, use a different one for each account! I use a password manager now, but I still remember the day I spent hours trying to guess my own password. “Was it BitcoinToTheMoon2017 or ToTheMoonBitcoin2017?” Never again.

- Hardware Wallets: If you’re serious about security (and if you’ve read this far, I’m guessing you are), get yourself a hardware wallet. It’s like having your own personal bodyguard for your crypto.

Take it from someone who’s been there, done that, and got the “I Survived the Crypto Crash” t-shirt – implementing these wallet security practices isn’t just important, it’s essential. Your future self will thank you when you’re sipping cocktails on your private island, knowing your digital fortune is safe and sound.

Securing Your Crypto Exchange Accounts

Now strap in because we’re discussing a topic near and dear to my heart (and my wallet) – securing your crypto exchange accounts. I know what some of you think: “But I thought we just talked about not keeping our crypto on exchanges!” Well, you’re not wrong, but unless you’re living under a rock (which, given some market conditions, might not be a bad idea), you’ll probably need to use an exchange at some point.

Let me take you back to a dark day in my crypto journey. Picture this: It’s 2018, I’m feeling on top of the world, my portfolio is greener than the Hulk, and I’m practically doing backflips every time I log into my favorite exchange. Then, one fateful morning, I tried to log in, and… nothing. My password doesn’t work. I start sweating. I checked my email, and there was a message saying my account had been compromised. Long story short, I lost a chunk of change that day, and it was a wake-up call I’ll never forget.

So, let’s dive into how you can avoid my mistakes and keep your exchange accounts locked down tighter than the prison realm:

- Choosing Reputable Exchanges: This might seem obvious, but not all exchanges are created equal. Do your homework! Look for exchanges with a solid track record, good security measures, and (ideally) some form of insurance. I once used an exchange because its fees were low, and it listed some obscure coins I wanted. That was a big mistake. The exchange was shadier than a palm tree, and poof—there went my funds. Stick to the well-known, well-regulated exchanges like Binance, folks.

- Two-Factor Authentication (2FA): If you remove nothing else from this section, remember to enable 2FA on everything! And I’m not talking about SMS 2FA (which can be intercepted). Use an authenticator app or, even better, a hardware key. After my account hack, I went full paranoid mode. Now, I’ve got more layers of 2FA than an onion. Overkill? Maybe. But I dare any hacker to get through all that!

- Withdrawal Whitelists and Address Books: This feature is a godsend. It lets you pre-approve addresses for withdrawals, so even if someone gets into your account, they can’t send your crypto to their wallet. I’ll admit I was lazy about setting this up at first. “It’s such a hassle,” I thought. But you know what’s a real hassle? Trying to track down stolen crypto. Trust me, take the time to set up your whitelist.

- Limiting Exchange Holdings: Remember, exchanges should be like bus stops—a place to make transfers, not to hang out indefinitely. Only keep what you need for trading on the exchange. I used to keep a big chunk of my portfolio on exchanges for “trading opportunities.” Yeah, those opportunities never came, but you know what did? Security breaches. Now, I only keep a small amount for immediate trading needs, and the rest goes straight to my hardware wallet.

Here’s a pro tip: Create a separate email address just for your crypto activities. Make it long, random, and impossible to guess. Use this address only for your exchange accounts.

Safe Storage of Recovery Information

Let’s talk about keeping your crypto wallet recovery information safe. I learned this the hard way, and boy, do I wish someone had given me a heads-up earlier! So, after buying my first Bitcoin, I felt like a tech genius. I’d set up my wallet, written down my recovery phrase on a sticky note, and stuck it to the bottom of my desk drawer. Foolproof, right? Wrong.

A few months later, I decided to deep clean my home office. You know how it goes—you start with good intentions, and suddenly, you’re knee-deep in old papers and forgotten knickknacks. In my cleaning frenzy, I tossed out a bunch of old sticky notes, including my recovery phrase. Cue the panic attack when I realized what I’d done.

After that heart-stopping moment, I knew I had to get serious about storing my recovery information safely. Here’s what I’ve learned since then:

First, write your recovery phrase on a sticky note. This is a big no-no. It’s like leaving your house key under the doormat—the first place a thief would look. Instead, consider using a metal backup plate. These babies are fireproof and waterproof, so your info stays safe even if disaster strikes.

Here’s something I learned recently – you can use something called a “seed phrase calculator” to generate multiple phrases that can recover your wallet. It’s like having spare keys for your crypto kingdom. Pretty neat, huh?

Protecting Against Phishing and Social Engineering

Let’s dive into the murky waters of phishing and social engineering in the crypto world. Lemme tell you, this stuff is no joke. I’ve had more close calls than I care to admit, and I’ve seen some pretty savvy folks get taken for a ride. So there I was, thinking I was hot stuff ’cause I’d been in the crypto game for a whole six months. I get this email, right? It’s all official-looking, saying I’d won some obscure altcoin in a giveaway I didn’t even remember entering. Free money? Sign me up! I clicked that link faster than you can say “Bitcoin.”

Big mistake. Huge. It turns out that the site was a carbon copy of a legit exchange but with one tiny difference in the URL. I’d already entered my login info when I realized something was off. Talk about a heart-stopping moment. Luckily, I caught on before any real damage was done, but it was close. Here’s the thing about phishing in crypto – it’s like regular phishing on steroids. These scammers are getting craftier by the day. They’re no longer sending out those old “Nigerian prince” emails.

They’re creating fake websites, Twitter accounts, and customer support lines. One trick I’ve learned is to always, ALWAYS double-check the URL. I mean, really look at it. Is that an ‘l’ or an ‘I’? Is there an extra letter you didn’t notice? It’s like a twisted game of “spot the difference,” but with your life savings on the line. And don’t even get me started on social engineering. These folks are smooth talkers; I’ll give ’em that. They’ll hit you up on social media, all friendly-like, talking about some hot new project.

Before you know it, they’re asking for your wallet address “to send you some free tokens.” not falling for that one again. Oh, and airdrops? Man, those things are like catnip for crypto newbies. Free tokens just for holding a certain coin? Sounds great, right? Well, sometimes it is. But other times, it’s just bait to get you to connect your wallet to a dodgy site. I’ve learned to treat every airdrop offer like a stray dog – approach cautiously, and don’t give it access to your home (or, in this case, your wallet).

Implementing Advanced Security Measures

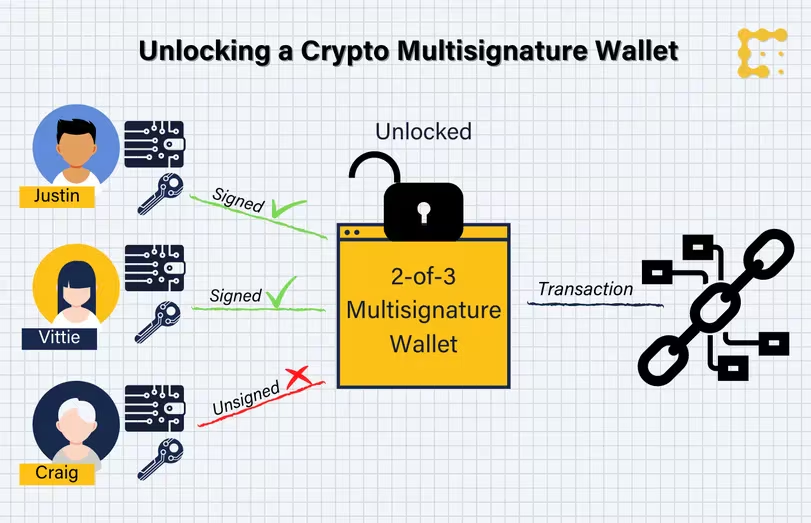

Let’s talk about leveling up your crypto security game. This is the stuff that separates the crypto kids from the blockchain bosses. Trust me, I’ve been through the wringer on this one. So there I was, feeling pretty smug with my hardware wallet and my fancy recovery phrase hidden away. I thought I was untouchable. Then I met this old man at a blockchain meetup (yeah, I go to those—don’t judge) who started schooling me on multi-sig wallets. Talk about a game-changer!

Multi-signature wallets, or multi-sig for short, are like having a safety deposit box that needs two keys to open. Except in this case, multiple private keys authorize a transaction. I set one up with a friend as the second signatory. Now, even if someone gets hold of my key, they can’t drain my funds without his approval. It’s saved my bacon more than once, especially when I thought I’d lost my hardware wallet after a wild night out. (Pro tip: always check the couch cushions first.)

But here’s where things get real—crypto inheritance planning. It’s not the most fun topic but bear with me. I had this wake-up call when my buddy’s dad passed away unexpectedly, taking the keys to a pretty hefty Bitcoin stash with him. It was a mess, let me tell you. After that, I sat down and had a long, awkward chat with my family about what to do with my crypto if I kicked the bucket.

It was not exactly dinner table conversation, but it was necessary. Now, onto something a bit less morbid—encrypted communication for transactions. This one’s for all you paranoid types out there (and in crypto, a little paranoia is healthy). I started using encrypted messaging apps for any crypto-related conversations. It’s like passing notes in class, but way cooler and with way higher stakes. Just remember, no matter how secure the app is, never share your private keys. That’s like rule number one of Crypto Club.

Staying Informed and Updated

Staying on top of crypto security is like trying to nail jello to a wall. Just when you think you’ve figured it out, some new threat pops up, and you’re back to square one. But hey, that’s part of the fun, right? …Right? Tell me about when I thought I was Mr. Crypto Security. I had my hardware wallet, my super-secret passphrase, the works. I felt pretty smug until I realized I hadn’t updated my wallet’s firmware in forever. Rookie mistake. It turns out that I had completely missed a major security patch.

Talk about a wake-up call. Since then, I’ve become a bit of a news junkie when it comes to crypto security. I’ve got alerts set up on my phone, I’m subscribed to more newsletters than I care to admit, and I spend too much time scrolling through crypto Twitter. My wife thinks I’m obsessed, but hey, better safe than sorry, right? I’ve learned that not all news sources are created equal. There’s a lot of noise out there, some of which can be downright dangerous. I once followed this “crypto guru” on YouTube who always talked about the latest security tips.

It turns out he was just shilling his own sketchy wallet app. Lesson learned: stick to reputable sources. I’m talking about established crypto news sites, official project blogs, and verified Twitter accounts of industry leaders. Just reading the news isn’t enough. You gotta put that knowledge into action. I have a reminder on my phone to check for weekly updates on all my crypto-related software. It’s a pain in the butt, but so is losing all your coins because you were too lazy to hit the ‘update’ button.

Crypto security forums and communities can be goldmines of information or cesspools of misinformation. It’s like the Wild West out there. I remember stumbling into this Telegram group that was all about “advanced” security techniques. It initially sounded legit until someone advocated storing private keys in a shared Google Doc. Yikes. But don’t let that scare you off. There are some great communities out there. I’ve found Reddit to be pretty solid, especially some of the more technical subreddits. Just remember to take everything with a grain of salt and always do your own research before implementing any new security measures.

Summary

Alright, let’s wrap this up. Talking about cryptocurrency security issues is like opening a can of worms, right? But it’s a can we gotta open, ’cause let’s face it, this stuff is important. We’ve covered a lot of ground here, from keeping your recovery phrases safe (and not on sticky notes—learn from my mistakes, people!) to protecting yourself against those sneaky phishing attempts. We’ve talked about leveling up with multi-sig wallets and even planning for the unthinkable with crypto inheritance. And don’t forget about staying in the loop with all the latest security news and updates.

Here’s the thing, though. All this info? It’s not worth squat if you don’t actually use it. I know that implementing all these security measures can be a pain in the rear. Trust me, I’ve been there. But you know what’s an even bigger pain? Losing all your hard-earned crypto because you couldn’t be bothered to update your wallet software.

The crypto world is like the Wild West; we’re all like cowboys trying to protect our digital gold. Except instead of six-shooters, we’ve got hardware wallets and VPNs. It’s a never-ending battle, but that’s part of the excitement, right? Remember, in the world of crypto, paranoia isn’t just healthy – it’s necessary. But with the right knowledge and tools, you can sleep easy knowing your digital assets are safe and sound.

Frequently Asked Questions

What are the best practices for ensuring cryptocurrency security?

To ensure cryptocurrency security, always use strong, unique passwords, enable two-factor authentication, store your assets in hardware wallets, and keep your software up to date. Regularly review your account activity and be aware of phishing attempts.

How can I protect my investments from cryptocurrency security threats?

Protect your investments by conducting thorough research on wallets and exchanges, using reputable services, and avoiding public Wi-Fi for transactions. Educate yourself on common scams and always verify the authenticity of communications you receive related to your investments.

What should I do if I think my cryptocurrency security has been compromised?

If you suspect a compromise, immediately change your passwords, enable two-factor authentication, and transfer your funds to a secure wallet if possible. Report the incident to the platform involved and consider seeking professional help to secure your remaining assets.

Are there specific tools or software to enhance cryptocurrency security?

Yes, there are several tools available to enhance cryptocurrency security, including hardware wallets like Ledger or Trezor, antivirus software, and password managers. Additionally, using a VPN can protect your internet connection while managing your cryptocurrency investments.

![[secure bitcoin wallets]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405725x325769434323760060-feature-120x86.png)

![[secure bitcoin wallets]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405725x325769434323760060-feature-350x250.png)

![[crypto asset security]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405711x482955841305053900-feature-350x250.png)

![[crypto asset security]](https://cryptohashira.com/wp-content/uploads/2024/11/1730320405711x482955841305053900-feature-120x86.webp)